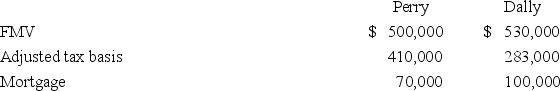

Perry Inc.and Dally Company entered into an exchange of real property.Here is the information for the properties to be exchanged.

Pursuant to the exchange,Perry assumed the mortgage on the Dally property,and Dally assumed the mortgage on the Perry property.Compute Perry's gain recognized on the exchange and its tax basis in the property received from Dally.

Pursuant to the exchange,Perry assumed the mortgage on the Dally property,and Dally assumed the mortgage on the Perry property.Compute Perry's gain recognized on the exchange and its tax basis in the property received from Dally.

Definitions:

Milgram

Refers to Stanley Milgram, a psychologist known for his experiments on obedience, demonstrating the extent to which individuals would follow orders from an authority figure.

Traditional Groups

These are groups that are formed through long-standing traditions or social customs, often bound by shared cultural or community practices.

Celebratory Mobs

Large groups of people gathering spontaneously to celebrate an event, which can sometimes lead to unruly or disruptive behavior.

Flash Mobs

Sudden gatherings of people at a predetermined location and time to perform an unusual or seemingly pointless act and then disperse quickly, often organized via social media.

Q12: New companies and those with volatile earnings

Q20: Lovely Cosmetics Inc.incurred $785,000 research costs on

Q48: Eight years ago,Prescott Inc.realized a $16,200 gain

Q55: Creighton,a calendar year corporation,reported $5,571,000 net income

Q61: Which of the following business expenses always

Q65: Which of the following statements regarding employee

Q81: In circumstances requiring an evaluative judgment,the tax

Q98: B&P Inc.,a calendar year corporation,purchased only one

Q107: Which of the following statements about the

Q114: Four years ago,Bettis Inc.paid a $5 million