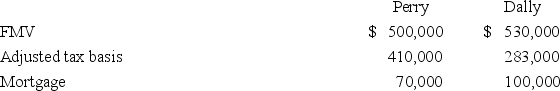

Perry Inc.and Dally Company entered into an exchange of real property.Here is the information for the properties to be exchanged.

Pursuant to the exchange,Perry assumed the mortgage on the Dally property,and Dally assumed the mortgage on the Perry property.Compute Dally's gain recognized on the exchange and its tax basis in the property received from Perry.

Pursuant to the exchange,Perry assumed the mortgage on the Dally property,and Dally assumed the mortgage on the Perry property.Compute Dally's gain recognized on the exchange and its tax basis in the property received from Perry.

Definitions:

Business Processes

Sequential steps or tasks undertaken by a company or organization to achieve specific business objectives or deliver services/products.

Substantial Performance

A contract law principle that allows for partial enforcement of a contract when most, but not all, aspects of the contract have been fulfilled.

Impossibility

A legal defense where a party claims it was not possible to fulfill the terms of a contract due to unforeseen circumstances.

Commercial Impracticability

A legal doctrine that excuses a party from fulfilling a contract due to unforeseen and extreme difficulties or expenses.

Q2: In 2015,Mrs.Owens paid $50,000 for 3,000 shares

Q30: A firm's choice of taxable year is

Q52: Zephex is a calendar year corporation.On December

Q55: As a general tax planning rule,an individual

Q80: Linda and Raj are engaged to be

Q83: Mrs.Beld sold marketable securities with a $79,600

Q85: If a new business organized as a

Q90: The tax character of an item of

Q91: Taxpayers may adopt the cash receipts and

Q95: Taxable income is defined as gross income