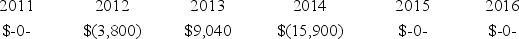

Proctor Inc.was incorporated in 2011 and adopted a calendar year.Here is a schedule of Proctor's net Section 1231 gains and (losses) reported on its tax returns through 2016.

In 2017,Proctor recognized a $25,000 gain on the sale of business land.How is this gain characterized on Proctor's tax return?

In 2017,Proctor recognized a $25,000 gain on the sale of business land.How is this gain characterized on Proctor's tax return?

Definitions:

Summer Wages

Compensation paid to employees for work performed during the summer season, often applied to temporary or seasonal positions.

Compounded Quarterly

Interest calculation method where interest is added to the principal sum so that each following period's interest is calculated on a growing principal.

Annual Interest

The amount of interest to be paid or earned over a one-year period, usually expressed as a percentage of the principal.

Investing

The act of allocating resources, usually money, in order to generate income or profit.

Q2: Which of the following statements about discount

Q5: Mr.Quick sold marketable securities with a $112,900

Q12: Locate the revenue procedure that includes the

Q18: The majority of individual taxpayers take the

Q25: Which of the following primary authorities is

Q29: The tax cost of a transaction depends

Q47: In March,a flood completely destroyed three delivery

Q66: The use of secondary authorities might be

Q75: The wash sale rule can result in

Q81: Which of the following statements about the