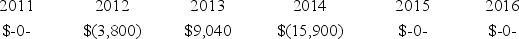

Proctor Inc.was incorporated in 2011 and adopted a calendar year.Here is a schedule of Proctor's net Section 1231 gains and (losses) reported on its tax returns through 2016.

In 2017,Proctor recognized a $25,000 gain on the sale of business land.How is this gain characterized on Proctor's tax return?

In 2017,Proctor recognized a $25,000 gain on the sale of business land.How is this gain characterized on Proctor's tax return?

Definitions:

Bulbospongiosus

A muscle of the perineum that plays a role in sexual function and urination.

Ischiocavernosus

A muscle that helps stiffen the penis or clitoris during sexual arousal by compressing the base of the erectile tissues.

Semispinalis Thoracis

A muscle in the back that extends from the thoracic vertebrae to the base of the skull, helping in the extension and rotation of the spine.

Multifidus

A muscle located in the spine that stabilizes the vertebrae and assists with spinal movements.

Q1: Omar Inc.paid a $24,000 expense,only $18,000 of

Q3: Dolzer Inc.sold a business asset with a

Q17: Which of the following is a Section

Q20: Lenoci Inc.paid $310,000 for equipment three years

Q41: A corporation can use the installment sale

Q51: A personal holding company is a corporation

Q68: This year,Zulou Industries capitalized $552,000 indirect costs

Q98: Partnerships offer more flexibility in allocating income

Q104: Six years ago,Linus Corporation granted Pauline a

Q121: A casualty loss realized on the destruction