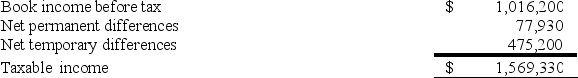

Goff Inc.'s taxable income is computed as follows.

Goff's tax rate is 34%.Which of the following statements is true?

Goff's tax rate is 34%.Which of the following statements is true?

Definitions:

Frequency of Interaction

The rate at which members of a group or social network communicate or interact with one another.

Socioemotional Leaders

Individuals within a group who primarily focus on maintaining and improving relationships, morale, and emotional well-being.

Scapegoat

A scapegoat is an individual or group unfairly blamed for problems or negative outcomes that they did not cause.

Multidimensional Plan

A strategy or approach that incorporates various aspects, levels, or factors to address complex issues comprehensively.

Q24: Which of the following statements about implicit

Q49: Five years ago,Q&J Inc.transferred land with a

Q50: Company N operates a mail order business

Q52: Which of the following statements concerning tax

Q53: Which of the following statements regarding commercial

Q54: Step 4 of the tax research process

Q68: Mr.Bilboa is a citizen of Portugal.Which of

Q68: Which of the following statements about tax

Q84: A tax should result in either horizontal

Q88: A fire destroyed furniture and fixtures used