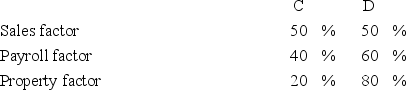

Albany,Inc.does business in states C and D.State D uses an apportionment formula that double-weights the sales factor; state C apportions income using an equally-weighted three-factor formula.Albany's before tax income is $3,000,000,and its sales,payroll,and property factors are as follows.

Calculate Albany's income taxable in each state.

Calculate Albany's income taxable in each state.

Definitions:

Volunteering

Offering services and time without expecting financial reward, typically to benefit a community or organization.

Social Networking Sites

Online platforms that allow users to create profiles, interact with friends and strangers, share content, and participate in social networking.

Networker

An individual who actively develops and maintains a network of contacts for professional or personal advancement.

Business Contacts

Individuals or entities involved in one's professional network, potentially offering opportunities for partnerships, sales, or networking.

Q4: The goal of tax planning is to

Q10: The trading of existing securities is known

Q12: Which of the following statements about implicit

Q31: Many taxpayers believe the income tax system

Q36: Large well-known companies often issue their own

Q41: What is the capital raising process referred

Q43: If you thought prices of share would

Q45: Individuals may find it more advantageous to

Q52: Businesses must withhold payroll taxes from payments

Q55: The City of Willford levies a flat