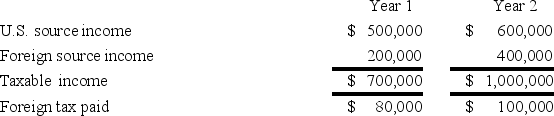

Jenkin Corporation reported the following for its first two taxable years.Corporate tax rate schedule.Assume that the tax rates for both the years are same.

Calculate Jenkin's U.S.tax liability for Year 2.

Calculate Jenkin's U.S.tax liability for Year 2.

Definitions:

U.S. Dollar Value

The worth of a good, service, or financial security denominated in terms of the United States dollar.

Norwegian Kroners

The official currency of Norway, symbolized as NOK.

U.S. Dollars

The official currency of the United States, which is used as a standard monetary unit for various international transactions.

Foreign Trade Zone

A designated location within a country where goods can be imported, stored, and processed without being subject to import duties until they enter the domestic market.

Q6: You have an APR of 7.5% with

Q10: Under U.S.tax law,corporations are entities separate and

Q16: When calculating the variance of a portfolio's

Q40: According to supply-side economic theory,a decrease in

Q48: Cramer Corporation and Mr.Chips formed a general

Q50: Company N operates a mail order business

Q52: International tax treaties generally allow a government

Q61: Treasury regulations are tax laws written by

Q75: The Internal Revenue Code is the primary

Q81: Wilmington,Inc.,a Pennsylvania corporation,manufactures computer components that it