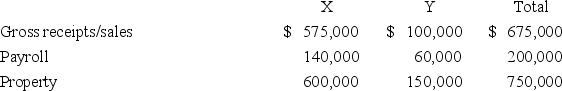

Origami does business in states X and Y.State X uses an equally-weighted three-factor apportionment formula and has a 4 percent state tax rate.State Y uses an apportionment formula that double-weights the sales factor and has a 6 percent tax rate.Cromwell's taxable income,before apportionment,is $3 million.Its sales,payroll,and property information are as follows.  a.Calculate Origami's apportionment factors,income apportioned to each state,and state tax liability.

a.Calculate Origami's apportionment factors,income apportioned to each state,and state tax liability.

b.State Y is considering changing its apportionment formula to a single sales factor.Given its current level of activity,would such a change increase or decrease Origami's state income tax burden? Provide calculations to support your conclusion.

Definitions:

Equilibrium

A state in a market where the quantity demanded equals the quantity supplied, resulting in a stable market price.

Consumer Surplus

The difference between the total amount that consumers are willing and able to pay for a good or service and the total amount that they actually pay.

Excess Quantity

A situation where the supply of a product exceeds the demand for it.

Consumer Surplus

is the difference between the total amount that consumers are willing to pay for a good or service and the total amount that they actually pay.

Q5: You purchased 250 shares on margin for

Q5: Which of the following result in a

Q13: Consider the following limit order book of

Q28: A revenue ruling is an example of:<br>A)Judicial

Q30: If Congress enacts a temporary change in

Q31: Calliwell Corporation is a Colorado corporation engaged

Q39: Corporations with taxable incomes in excess of

Q77: The IRS scrutinizes related party transactions more

Q78: Mr.Trail engaged in a current-year transaction generating

Q89: Fleet,Inc.owns 85% of the stock of Pete,Inc.and