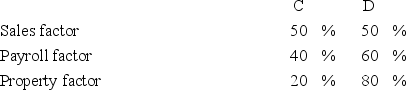

Albany,Inc.does business in states C and D.State D uses an apportionment formula that double-weights the sales factor; state C apportions income using an equally-weighted three-factor formula.Albany's before tax income is $3,000,000,and its sales,payroll,and property factors are as follows.

Calculate Albany's income taxable in each state.

Calculate Albany's income taxable in each state.

Definitions:

Political Competency

The knowledge, abilities, and skills required to effectively participate in and influence the political process.

Interactional Competency

The ability to effectively communicate and interact with others, recognizing and adapting to social cues and norms.

Administrative Policies

Administrative policies are the rules, guidelines, and procedures established by organizations or government bodies to regulate operations, manage conduct, and guide decision-making processes.

Policy Practitioner

A professional involved in the development, advocacy, implementation, and evaluation of public policies and programs.

Q2: Ms.Penser resides in the city of Lanock,Tennessee.She

Q36: If a corporation's depreciation expense for regular

Q38: Life-cycle funds are _.<br>A)growth funds<br>B)closed-end funds<br>C)balanced funds<br>D)stable

Q43: A tax meets the standard of sufficiency

Q44: The city of Berne recently enacted a

Q54: Southern,an Alabama corporation,has a $7 million excess

Q57: In contrast to a partnership,every member of

Q59: Which of the following statements concerning sales

Q69: Which of the following items would be

Q82: Which of the following is an example