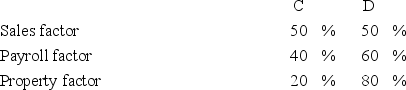

Albany,Inc.does business in states C and D.State C uses an apportionment formula that double-weights the sales factor; state D apportions income using an equally-weighted three-factor formula.Albany's before tax income is $3,000,000,and its sales,payroll,and property factors are as follows.

Calculate Albany's income taxable in each state.

Calculate Albany's income taxable in each state.

Definitions:

Utility

The total satisfaction or benefit received from consuming a good or service.

Place Utility

The value added to products by having them available at the location where they are needed or desired by consumers.

Boarding Pass

A document provided by an airline during check-in, granting a passenger permission to enter the secure area of an airport and board a specific flight.

Service Station

A facility dedicated to the sale of gasoline and often providing maintenance and repair services for vehicles.

Q7: A corporation that is unable to meet

Q13: Which of the following federal taxes is

Q28: If you want the trade done quickly,

Q37: An investor buys $8 000 worth of

Q43: If you thought prices of share would

Q58: A dollar available today is always worth

Q67: Which of the following is not primary

Q74: Torquay Inc.'s 2016 taxable income was $9,782,200,and

Q78: The federal income tax law allows individuals

Q80: Borough,Inc.is entitled to a rehabilitation credit of