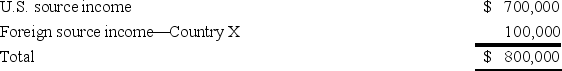

Global Corporation,a U.S.multinational,began operations this year.Global had pretax U.S.source income and foreign source income as follows.Corporate tax rate schedule.

Global paid $25,000 income tax to Country X.What is Global's U.S.tax liability if it takes the foreign tax credit?

Global paid $25,000 income tax to Country X.What is Global's U.S.tax liability if it takes the foreign tax credit?

Definitions:

Entry or Exit

The process of a firm beginning operations in a market (entry) or leaving a market (exit), influenced by factors like profitability and barriers to entry.

Industry Expanding

A phase where the sector's businesses are growing in terms of production, workforce size, or market reach.

Production Facilities

Physical locations designed and equipped for the production of goods or services.

Raw Materials

The basic, unprocessed inputs used in manufacturing or production processes to create goods and products.

Q2: Grant and Amy have formed a new

Q38: Which one of the following is a

Q54: Congress originally enacted the federal estate and

Q55: Which of the following are true statements

Q57: A company must release a prospectus _.<br>A)before

Q60: The performance fees of managed funds is

Q61: The final step in the tax research

Q62: Late in the current year,Jolsen Company signed

Q69: All states assessing an income tax use

Q103: The stock of closely held corporations is