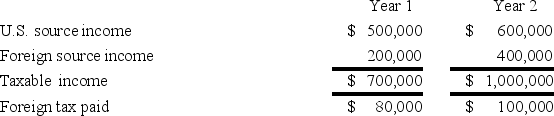

Jenkin Corporation reported the following for its first two taxable years.Corporate tax rate schedule.Assume that the tax rates for both the years are same.

Calculate Jenkin's U.S.tax liability for Year 2.

Calculate Jenkin's U.S.tax liability for Year 2.

Definitions:

Efficient Market

A market in which asset prices fully reflect all available information, making it impossible to consistently achieve higher returns than the overall market.

Unexpectedly High Earnings

Unexpectedly high earnings refer to a company's reported profits that significantly exceed analysts' forecasts or the company's own guidance.

Abnormal Price Change

A significant variation in the price of a security or trading instrument that cannot be explained by market fundamentals and might be attributed to extenuating circumstances or events.

Selection Bias

Selection bias is a distortion in statistical analysis resulting from the method of collecting samples, potentially causing results to not be representative of the wider population.

Q4: Compared to listed investments, investors have _

Q7: The industry of Australia's managed funds ranks

Q7: Money Market securities are characterised by _.<br>I.

Q11: The foreign tax credit is available only

Q29: The tax cost of a transaction depends

Q39: Corporations,LLCs,and partnerships are all taxable entities.

Q43: Managed funds provide the following for their

Q79: A partner's tax basis in his or

Q79: Which of the following federal taxes is

Q82: Ms.Teague incurred a $35,000 expense.If her marginal