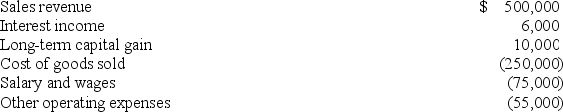

Waters Corporation is an S corporation with two equal shareholders,Mia Jones and David Kerns.This year,Waters recorded the following items of income and expense:

Waters distributed $25,000 to each of its shareholders during the year.Calculate the S corporation's ordinary (non-separately stated) income and indicate which items must be separately stated.

Waters distributed $25,000 to each of its shareholders during the year.Calculate the S corporation's ordinary (non-separately stated) income and indicate which items must be separately stated.

Definitions:

Q3: Market risk is also called _ and

Q15: Which of the following taxes is not

Q21: The investment philosophy of ETFs is _.<br>A)pro-active

Q24: Stone Harbor Products takes out a bank

Q33: In order to construct a riskless portfolio

Q37: The Internal Revenue Service's cost of collecting

Q53: Foreign value-added taxes and excise taxes are

Q54: Investors who wish to liquidate their holdings

Q64: Businesses are required by law to withhold

Q66: Acme Inc.'s property taxes increased by $65,000