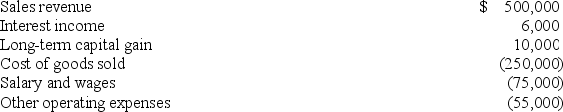

Waters Corporation is an S corporation with two equal shareholders,Mia Jones and David Kerns.This year,Waters recorded the following items of income and expense:

Waters distributed $25,000 to each of its shareholders during the year.If Mia has no other sources of income,what is her gross income for the year?

Waters distributed $25,000 to each of its shareholders during the year.If Mia has no other sources of income,what is her gross income for the year?

Definitions:

Bold Text

A font style used to make letters and symbols darker and more prominent than surrounding text for emphasis.

CTRL+SHIFT+RIGHT ARROW

The CTRL+SHIFT+RIGHT ARROW keyboard shortcut is typically used in text editing and word processing to select text from the cursor position to the end of the current word or line.

CTRL+SHIFT+>

A keyboard shortcut often used in text editing software to increase the font size of the selected text.

CTRL+ENTER

In many applications, CTRL+ENTER is a keyboard shortcut used to perform a specific function, such as inserting a page break or sending an email.

Q3: Aaron James has a qualifying home office.The

Q4: If Gamma Inc.is incorporated in Ohio and

Q17: An individual who goes short in a

Q34: Which of the following is not a

Q40: BMX Company engaged in a current-year transaction

Q46: You find that the annual standard deviation

Q54: Investors who wish to liquidate their holdings

Q58: Lexington Corporation conducts business in four states.In

Q58: A nondeductible charitable contribution is a permanent

Q77: The IRS scrutinizes related party transactions more