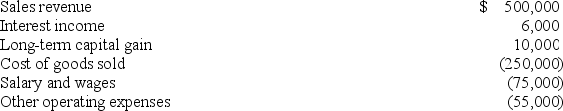

Waters Corporation is an S corporation with two equal shareholders,Mia Jones and David Kerns.This year,Waters recorded the following items of income and expense:

Waters distributed $25,000 to each of its shareholders during the year.If Mia's adjusted tax basis in her partnership interest was $50,000 at the beginning of the year,compute her adjusted tax basis in her partnership interest at the end of the year.

Waters distributed $25,000 to each of its shareholders during the year.If Mia's adjusted tax basis in her partnership interest was $50,000 at the beginning of the year,compute her adjusted tax basis in her partnership interest at the end of the year.

Definitions:

Accounting

The recording, measurement, and interpretation of financial information.

Bookkeeping

The systematic recording of financial transactions and maintenance of financial records for a business or individual.

Q16: Which of the following statements about the

Q30: You have the following rates of return

Q31: Many taxpayers believe the income tax system

Q41: If an investor wants to sell their

Q41: Holter Inc.owns an investment that generated $120,000

Q50: If State H increases its sales tax

Q65: A user fee entitles the payer to

Q69: Which of the following items would be

Q75: A shareholder in an S corporation includes

Q97: Under most tax treaties,income attributable to a