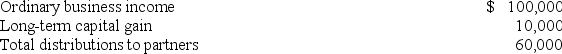

Mutt and Jeff are general partners in M&J Partnership and share profits and losses equally.Partnership operations for the current tax year were:

Mutt's tax basis in his partnership interest at the beginning of the current year was $12,000.What is his basis at the beginning of next year?

Mutt's tax basis in his partnership interest at the beginning of the current year was $12,000.What is his basis at the beginning of next year?

Definitions:

Cerebrum

The largest part of the brain, responsible for voluntary activities, speech, senses, thought, and memory.

Reye Syndrome

A rare but serious condition that causes swelling in the liver and brain, often associated with aspirin use in children recovering from a viral infection.

Avoidance of Aspirin

A medical recommendation for certain individuals to prevent adverse reactions or exacerbation of health conditions.

Immunization

The process through which a person becomes protected against a disease through vaccination.

Q6: Someone who invests in the Vanguard Index

Q30: A provision in the tax law designed

Q36: Financial assets represent _ of total assets

Q37: Which of the following statements concerning the

Q39: Technical analysis focuses on _.<br>A)finding opportunities for

Q47: Purchases of new issues of share take

Q53: Fundamental analysis is likely to yield best

Q65: During the current year,Margie earned wage income

Q77: During 2017,Scott Howell received a salary of

Q95: Bisou Inc.made a $48,200 contribution to charity