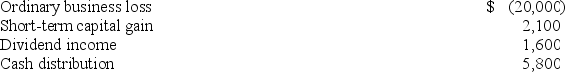

Perry is a partner in a calendar year partnership.His Schedule K-1 for the current tax year showed the following:

Perry's tax basis in his partnership interest at the beginning of the year was $15,400.How much of the ordinary loss may he deduct on his Form 1040?

Perry's tax basis in his partnership interest at the beginning of the year was $15,400.How much of the ordinary loss may he deduct on his Form 1040?

Definitions:

Pervasive Developmental

Refers to a group of disorders characterized by delays in the development of socialization and communication skills, including autism.

Childhood Disintegrative

A rare condition characterized by late onset (usually after at least two years of normal development) of developmental delays in language, social function, and motor skills.

Repetitive Manner

Performing actions or behaviors over and over again in a consistent and unvarying way.

Self-Stimulatory Behaviors

Repetitive actions or movements, often seen in individuals with developmental disorders, that are used for self-soothing or sensory stimulation.

Q11: Which of the following statements about vertical

Q13: The Schedule M-3 reconciliation requires less detailed

Q22: Congress plans to amend the federal income

Q28: According to the CAPM, what is the

Q51: In securities markets, there should be a

Q56: Lexington Associates,Inc.is a personal service corporation.This year,Lexington

Q70: The property tax on a rent house

Q89: Matthew earned $150,000 in wages during 2017.FICA

Q96: Cramer Corporation and Mr.Chips formed a general

Q102: The sales factor in the UDITPA state