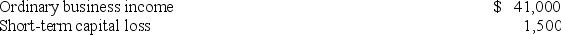

Alex is a partner in a calendar year partnership.His partnership Schedule K-1 for the current tax year showed the following:

Alex has a $7,000 loss carryforward from the partnership last year,which he could not deduct because of the basis limitation.What is his tax basis in his partnership interest at the end of the current tax year?

Alex has a $7,000 loss carryforward from the partnership last year,which he could not deduct because of the basis limitation.What is his tax basis in his partnership interest at the end of the current tax year?

Definitions:

Philosophers and Scientists

Individuals engaged in systematic approaches to understanding the world; philosophers explore fundamental questions about existence, knowledge, and ethics, while scientists focus on empirical evidence and testable theories.

Conventions

General agreement about terms and/or practices.

Interpretation

A way of understanding, a view of a set of facts, from a certain perspective.

Universal Causality

The philosophical concept that every event or action results from preceding events in accordance with the laws of nature.

Q24: The purchase of a futures contract gives

Q26: _ portfolio construction starts with selecting attractively

Q28: _ is a mechanism to mitigate potential

Q32: Investors require a risk premium as compensation

Q35: According to recent research securities markets fully

Q36: The semi-strong form of the EMH states

Q41: _ portfolio management calls for holding diversified

Q43: _ is an example of an agency

Q52: Businesses must withhold payroll taxes from payments

Q76: The majority of state governments raise revenue