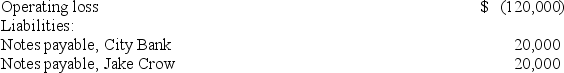

Cactus Company is a calendar year S corporation with the following current year information:

On January 1,John James bought 50% of Cactus Company stock for $30,000.How much of the operating loss may John deduct on his Form 1040?

On January 1,John James bought 50% of Cactus Company stock for $30,000.How much of the operating loss may John deduct on his Form 1040?

Definitions:

Price Sensitive

Characteristic of information or news that could influence the price of securities if it were made public.

Zero-Coupon Bond

A type of bond that does not pay interest during its life but is sold at a discount from its face value and redeemed at par at maturity.

Immunization Strategies

Financial strategies used to shield a bond portfolio from the effects of interest rate fluctuations by balancing the duration of assets and liabilities.

Interest Rate Sensitivity

The degree to which the value of an investment, particularly fixed-income securities, changes in response to variations in interest rates.

Q14: Mr.Vail made an offer to purchase a

Q19: Consider two perfectly negatively correlated risky securities,

Q32: Random price movements indicate _.<br>A)irrational markets<br>B)that prices

Q32: Australian Real Estate Investment Trust is an

Q34: You have calculated the historical dollar-weighted return,

Q38: Brace,Inc.owns 90% of West common stock.This year,Brace

Q43: Managed funds provide the following for their

Q44: Consider the following two investment alternatives. First,

Q48: The domestic production activities deduction is a

Q99: Which of the following items is not