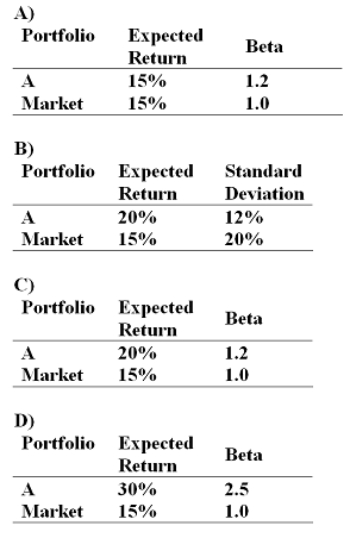

If the simple CAPM is valid and all portfolios are priced correctly, which of the situations below are possible?

Consider each situation independently and assume the risk-free rate is 5%.

Definitions:

Last Name

The family or surname part of a person's full name, typically used for identification and formal purposes.

Ascending Order

A sorting method where values are arranged from smallest to largest, or in an alphabetical order from A to Z.

CTRL+ C

A keyboard shortcut commonly used to copy selected text or items to the clipboard.

Banded Rows

A visual enhancement in spreadsheets or tables where alternating rows are shaded differently to improve readability.

Q2: You can be sure that a bond

Q11: A possible limit on arbitrage activity that

Q12: At the early stage of an individual's

Q32: Australian Real Estate Investment Trust is an

Q33: You run a regression of a share's

Q47: Suppose you pay $9800 for a $10

Q54: June call and put options on King

Q56: Even if the markets are efficient, professional

Q64: Businesses are required by law to withhold

Q66: A corporate shareholder usually cannot be held