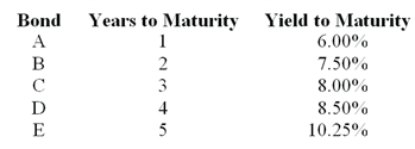

Consider the following $1 000 par value zero-coupon bonds:  The expected one-year interest rate two years from now should be ________.

The expected one-year interest rate two years from now should be ________.

Definitions:

Pyramidal Tract Lesions

Damage or injuries to the pyramidal tracts, which are major pathways in the central nervous system that transmit motor signals from the brain to the spinal cord and control voluntary movements.

Computed Tomography

A diagnostic imaging technique that uses a series of computer-processed combinations of many X-ray measurements taken from different angles to produce cross-sectional images of specific areas of a scanned object, allowing the user to see inside the object without cutting.

Pain Medication

Medication used to alleviate pain, ranging from over-the-counter analgesics to prescription opioids.

Equipment

Tools, devices, or machinery designed for specific tasks, especially in professional settings like medical or industrial environments.

Q4: Under a 'passive core' portfolio management strategy,

Q11: A possible limit on arbitrage activity that

Q13: The M<sup>2</sup> measure is a variant of

Q13: The term 'complete portfolio' refers to a

Q22: An investor with high risk aversion will

Q26: Security X has an expected rate of

Q35: Assuming semiannual compounding, a 20-year zero coupon

Q37: The return on the risky portfolio is

Q48: My pension plan will pay me a

Q56: Diversification can reduce or eliminate _ risk.<br>A)all<br>B)systematic<br>C)non-systematic<br>D)only