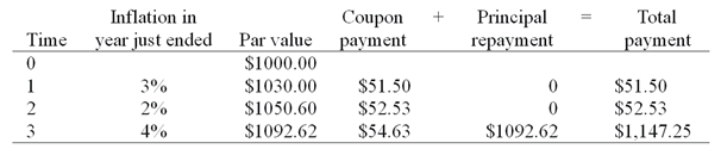

Consider a newly issued TIPS bond with a three year maturity, par value of $1000, and a coupon rate of 5%. Assume annual coupon payments.  What is the nominal rate of return on the TIPS bond in the first year?

What is the nominal rate of return on the TIPS bond in the first year?

Definitions:

Principal Balance

The original amount of money lent or invested, before any interest or profit is added to it or any payments are made.

Amortized

Definition: The process of spreading out a loan into a series of fixed payments over time.

Equal Payments

Regular payments of the same amount over a specified period, commonly used in loan repayment schedules.

First Payment

The initial amount paid at the start of a financial agreement or loan.

Q6: Someone who invests in the Vanguard Index

Q13: All else the same, an American style

Q14: As a type of secondary capital raising,

Q30: The value of a derivative security _.<br>A)depends

Q36: If interest rates increase, business investment expenditures

Q41: A company with an expected earnings growth

Q44: A one-year oil futures contract is selling

Q47: You write a put option on a

Q52: You have an investment horizon of 6

Q57: Liquidity is a risk factor that _.<br>A)has