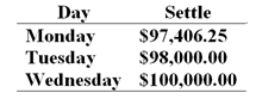

On Monday morning you sell one June T-bond futures contract at 97: 27 or for $97 843.75. The contract's face value is $100 000. The initial margin requirement is $2 700 and the maintenance margin requirement is $2 000 per contract. Use the following price data to answer the question.  At the close of day Tuesday your cumulative rate of return on your investment is

At the close of day Tuesday your cumulative rate of return on your investment is

Definitions:

Q2: You can be sure that a bond

Q4: Perfect dynamic hedging requires _.<br>A)a smaller capital

Q16: Common-size balance sheets are prepared by dividing

Q17: The measure of risk used in the

Q23: Data for selected fruits purchased at wholesale

Q24: Hedge fund managers receive incentive bonuses when

Q44: A bond currently has a price of

Q44: A new machine that fills tubes of

Q49: From the perspective of determining profit and

Q51: You purchase one IBM March 120 put