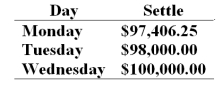

On Monday morning you sell one June T-bond futures contract at 97:27 or for $97,843.75. The contract's face value is $100,000. The initial margin requirement is $2,700 and the maintenance margin requirement is $2,000 per contract. Use the following price data to answer questions 67 through 70.

-If rf is greater than d then we know that _______________.

Definitions:

Purchase Discount

is a reduction in the price of goods bought, usually due to early payment by the buyer to the seller.

Perpetual Inventory System

A perpetual inventory system continuously tracks inventory levels and costs, updating records with each receipt or sale of goods.

Physical Inventory

The process of counting by hand the actual inventory that a company holds in its premises, as opposed to counting based on purchase and sale records.

Cost Of Goods Sold

Expenses directly incurred from the manufacturing of a company’s goods for sale, such as materials and labor.

Q14: Conventional finance theory assumes investors are _

Q24: Hedge fund managers receive incentive bonuses when

Q30: An industry analysis for manufacturers of a

Q41: To create a portfolio with a duration

Q47: You write a put option on a

Q49: Analysis of bond returns over a multiyear

Q50: The trend forecast equation is <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2636/.jpg"

Q52: A common share pays an annual dividend

Q54: Moving to higher yield bonds, usually with

Q82: In acceptance sampling,if the number of defects