Multiple Choice

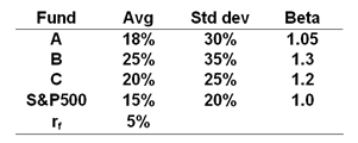

The risk-free rate, average returns, standard deviations and betas for three funds and the S&P500 are given below.  What is the T2 measure for Portfolio A?

What is the T2 measure for Portfolio A?

Definitions:

Related Questions

Q1: Consider the theory of active portfolio management.

Q14: Data for fuel oil and gasoline purchased

Q21: A recent study of the relationship between

Q25: A firm purchases goods on credit worth

Q27: A long hedger will _ from an

Q43: Sensitivity analysis examines the effects that changes

Q54: For an annual time series extending from

Q61: The chi-square statistic _.<br>A)is greater than or

Q65: To calculate monthly typical seasonal indexes,how many

Q85: For the third quarter,the sales are 2,000