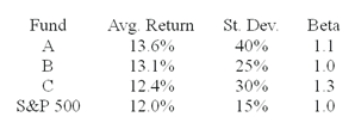

The average returns, standard deviations and betas for three funds are given below along with data for the S&P 500 index. The risk-free return during the sample period is 6%.  You wish to evaluate the three mutual funds using the Treynor measure for performance evaluation. The fund with the highest Treynor measure of performance is ________.

You wish to evaluate the three mutual funds using the Treynor measure for performance evaluation. The fund with the highest Treynor measure of performance is ________.

Definitions:

Producing Automobiles

The process of manufacturing cars, which involves assembling various components like engines, frames, and electronics.

Productivity

A measure of the efficiency of production, often calculated by dividing total output by the total inputs used in the production process.

Demand

The amount of a good or service that buyers are ready and capable of buying at different price levels over a given time frame.

Human Capital

The expertise, know-how, and practical experiences that a person or collective maintains, regarded in relation to their financial or worth importance to a business or country.

Q11: The national sales manager for "I colored

Q19: A firm has an ROA of 19%,

Q20: The manager of Paul's fruit and vegetable

Q36: _ is a life insurance policy that

Q47: Which of the following is not a

Q48: Which one of the following performance measures

Q59: The duration of a 5-year zero coupon

Q60: In the linear trend equation,Y = a

Q83: To calculate quarterly typical seasonal indexes,how many

Q93: The shape of the chi-square distribution depends