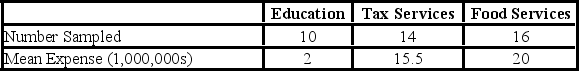

A random sample of 40 companies with assets over $10 million was surveyed and asked to indicate their industry and annual computer technology expense. The ANOVA comparing the average computer technology expense among three industries rejected the null hypothesis. The mean square error (MSE) was 195. The following table summarized the results:  Based on the comparison between the mean annual computer technology expense for companies in the education and tax services industries,________.

Based on the comparison between the mean annual computer technology expense for companies in the education and tax services industries,________.

Definitions:

Fast Food Chain

A series of restaurants serving quick-service food items, standardized across locations for consistency and speed.

Contractual Business Arrangement

A legally binding agreement between two or more parties outlining the terms and conditions of a business relationship.

Pledge Funds

Investment funds where investors commit capital to be called upon by the fund managers as investment opportunities arise, typically used in real estate and private equity.

Limit Expenditure

Strategies or practices aimed at restricting the amount of money spent on specific goods, services, or activities.

Q36: As a general rule of thumb,if the

Q38: A true/false test consists of six questions.

Q39: A research firm needs to estimate within

Q41: The take-home pay of an employee working

Q42: A recent study focused on the number

Q44: The claim that "male and female students

Q56: If an average of 60 customers are

Q57: Nonparametric tests require no assumptions about the

Q58: When is it appropriate to use the

Q65: Given the following ANOVA table for three