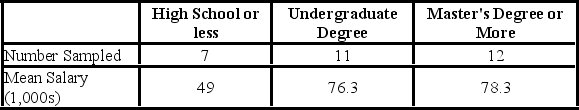

A random sample of 30 executives from companies with assets over $1 million was selected and asked for their annual income and level of education. The ANOVA comparing the average income among three levels of education rejected the null hypothesis. The mean square error (MSE) was 243.7. The following table summarized the results:  Based on the comparison between the mean annual incomes for executives with undergraduate and master's degrees or more,________.

Based on the comparison between the mean annual incomes for executives with undergraduate and master's degrees or more,________.

Definitions:

Opportunity Costs

The cost of forgoing the next best alternative when making a decision or choice.

Implicit Costs

Indirect, non-out-of-pocket expenses which represent the opportunity costs of using resources owned by the firm for its operations.

Accounting Profit

The difference between total revenue and explicit costs.

Economic Profit

The difference between total revenue and total costs, including explicit and implicit costs.

Q1: If the hypothesis H<sub>0</sub>: β<sub>1</sub> = 0

Q2: We test for a hypothesized difference between

Q11: Use the following table to determine whether

Q24: If the correlation between the two independent

Q29: The mean score of a college entrance

Q39: An experiment consists of making 80 telephone

Q45: For small samples,the test statistic for the

Q59: A survey of 50 retail stores revealed

Q61: The Bureau of the Census reported that

Q79: A two-way ANOVA with interaction has how