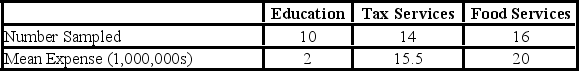

A random sample of 40 companies with assets over $10 million was surveyed and asked to indicate their industry and annual computer technology expense. The ANOVA comparing the average computer technology expense among three industries rejected the null hypothesis. The mean square error (MSE) was 195. The following table summarized the results:  When comparing the mean annual computer technology expense for companies in the education and tax services industries,which of the following 95% confidence interval can be constructed?

When comparing the mean annual computer technology expense for companies in the education and tax services industries,which of the following 95% confidence interval can be constructed?

Definitions:

Selling Price

The price at which a business offers its product or service for sale to consumers, determined by various factors including cost and market demand.

Manufacturing Overhead Cost

Indirect costs associated with manufacturing, not directly tied to the product, such as factory maintenance, utilities, and salary of the supervisory staff.

Contribution Margin

The gap between sales income and variable expenses, showing the extent to which income aids in addressing fixed costs and creating profit.

Selling Price

The amount of money charged for a product or service, or the sum a customer is willing to pay.

Q25: A sales manager for an advertising agency

Q25: The time to fly between New York

Q28: To conduct a test of hypothesis with

Q32: A sign test cannot be applied when

Q32: Several employees have submitted different methods of

Q55: A coin is tossed three times. The

Q56: Bones Brothers & Associates prepare individual tax

Q60: In multiple regression analysis,residuals (Y − <img

Q63: An index of clothing prices for 2006

Q71: To study the population of consumer perceptions