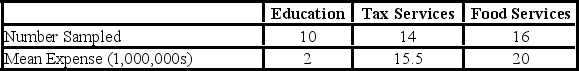

A random sample of 40 companies with assets over $10 million was surveyed and asked to indicate their industry and annual computer technology expense. The ANOVA comparing the average computer technology expense among three industries rejected the null hypothesis. The mean square error (MSE) was 195. The following table summarized the results:  Based on the comparison between the mean annual computer technology expense for companies in the tax service and food service industries,the 95% confidence interval shows an interval of −5.85 to 14.85 for the difference. This result indicates that ________.

Based on the comparison between the mean annual computer technology expense for companies in the tax service and food service industries,the 95% confidence interval shows an interval of −5.85 to 14.85 for the difference. This result indicates that ________.

Definitions:

Treasury Bonds

Treasury Bonds are long-term government debt securities issued by the U.S. Treasury, with maturity periods typically ranging from 20 to 30 years.

Futures Contracts

Agreements, enforceable by law, to acquire or dispose of certain commodities or financial assets at a price agreed upon now, to be transacted at a later date.

Hedge Cost Risk

Hedge cost risk refers to the potential variability in the expense of hedging strategies, which are used to mitigate financial risks associated with currency, interest rates, or commodities.

Bushels

A unit of volume that is used primarily in the United States to measure quantities of agricultural commodities and dry goods.

Q5: For a normal distribution,what is the likelihood

Q5: For the following distribution: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2636/.jpg" alt="For

Q30: The size of the sampling error is

Q45: The coefficient of determination is the proportion

Q56: What are the critical values for a

Q57: A test statistic is a value computed

Q68: A college professor noted that the grades

Q72: To apply the Kruskal-Wallis test,the samples selected

Q74: An accelerated life test on a large

Q90: For a chi-square test involving a contingency