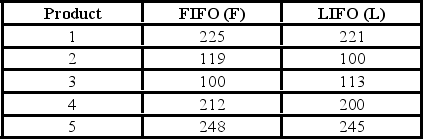

Accounting procedures allow a business to evaluate their inventory costs based on two methods: LIFO (last in first out) or FIFO (first in first out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference,they computed FIFO − LIFO for each product. We would like to determine if the LIFO method results in a lower cost of inventory than the FIFO method.  What is the alternate hypothesis?

What is the alternate hypothesis?

Definitions:

Readability, Clarity

The ease with which text can be read and understood by the audience, often influenced by the writer's choice of words, sentence structure, and organization.

Mechanics

The branch of physics concerned with the motion of objects and the forces that cause this motion.

Audience Analysis

The process of examining and understanding the characteristics of the audience for whom a message is intended.

Editing Skills

The ability to revise and improve a text by correcting errors and making it clearer and more effective.

Q9: What does the complement rule state?<br>A) P(A)

Q12: The central limit theorem allows us to

Q14: Two accounting professors decided to compare the

Q18: A sample standard deviation is the best

Q21: When using Student's t to compute an

Q23: In a stem-and-leaf display,the leaf represents the

Q34: Two accounting professors decided to compare the

Q49: An automatic machine inserts mixed vegetables into

Q62: A multiple regression model includes (X<sub>1</sub>)(X<sub>2</sub>). The

Q73: Suppose an automobile manufacturer designed a radically