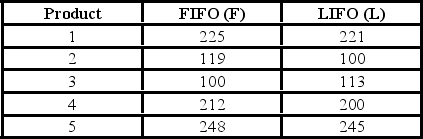

Accounting procedures allow a business to evaluate their inventory costs based on two methods: LIFO (last in first out) or FIFO (first in first out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference,they computed FIFO − LIFO for each product. We would like to determine if the LIFO method results in a lower cost of inventory than the FIFO method.  What are the degrees of freedom?

What are the degrees of freedom?

Definitions:

Heart Rate

The number of times the heart beats per minute, indicating cardiovascular activity and health.

Infection

The entry and proliferation of microorganisms like bacteria, viruses, and parasites inside the body, which are typically not found there.

Severe Sepsis

A significant complication of sepsis characterized by organ dysfunction and the body's extreme response to infection.

Organ System

A group of organs that work together to perform one or more functions within the body. Each has a specific role but works with other systems.

Q5: For the following distribution: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2636/.jpg" alt="For

Q7: A hypothesis regarding the weight of newborn

Q17: A company is studying the number of

Q23: A national manufacturer of ball bearings is

Q44: The claim that "male and female students

Q51: The best example of a null hypothesis

Q51: For a binomial distribution,the mean is 0.6

Q57: In the Kruskal-Wallis test for the following

Q70: To apply the special rule of addition,the

Q74: The marketing department of a nationally known