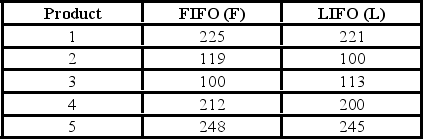

Accounting procedures allow a business to evaluate their inventory costs based on two methods: LIFO (last in first out) or FIFO (first in first out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference,they computed FIFO − LIFO for each product. We would like to determine if the LIFO method results in a lower cost of inventory than the FIFO method.  What is the alternate hypothesis?

What is the alternate hypothesis?

Definitions:

Total Utility

The total satisfaction or benefit that a person derives from consuming a certain quantity of goods or services.

Budget Line

A graphical representation of all possible combinations of two goods that a consumer can purchase at given prices and within a fixed budget.

Money Income

The total amount of monetary earnings received by an individual or household, including wages, salaries, and other forms of income.

Alternative Combinations

Alternative combinations refer to different ways that resources can be allocated to produce varying outputs of goods and services in an economy.

Q4: The joint probability of two events,A and

Q9: A company is researching the effectiveness of

Q16: If all the plots on a scatter

Q22: When an event's probability depends on the

Q26: A probability distribution is a mutually exclusive

Q32: A group of employees of Unique Services

Q46: A frequency distribution has a mean of

Q62: A large department store examined a sample

Q63: The decision rule for a small sample

Q67: Tables of normal distribution probabilities are found