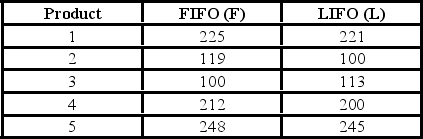

Accounting procedures allow a business to evaluate their inventory costs based on two methods: LIFO (last in first out) or FIFO (first in first out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference,they computed FIFO − LIFO for each product. We would like to determine if the LIFO method results in a lower cost of inventory than the FIFO method.  What are the degrees of freedom?

What are the degrees of freedom?

Definitions:

Postdated Check

A check written with a future date, preventing it from being cashed or deposited until that date.

Bank Reconciliation

The process of matching and comparing figures from the accounting records against those presented on a bank statement to ensure they are in agreement.

Deposit in Transit

Funds that have been deposited by a company in its bank account but have not yet been recorded by the bank, leading to a timing difference in the company's accounting records.

NSF Notation

A notation made by banks on a bounced check indicating "non-sufficient funds," meaning the account does not have enough money to cover the check.

Q10: The college of business was interested in

Q16: The Office of Student Services at a

Q32: For a one-tailed test with a 0.05

Q33: A Type II error is the probability

Q63: The value of the correlation coefficient (r)_.<br>A)can

Q64: To employ Analysis of Variance (ANOVA),the populations

Q70: The variance inflation factor can be used

Q77: Which of the following is true in

Q79: David's gasoline station offers 4 cents off

Q82: A recent study of the relationship between