The following are key terms in Chapter 13 that relate to accounting for not-for-profit organizations:

A.Nonexchange transactions

B.Temporarily restricted net assets

C.Collections

D.Variance power

E.Exchange transactions

F.Board-designated net assets

G.Permanently restricted net assets

H.Promise to give

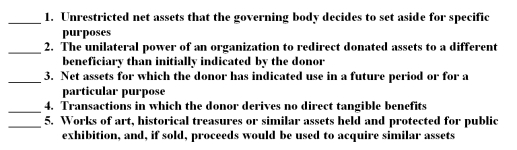

For each of the following definitions,indicate the key term from the list above that best matches by placing the appropriate letter in the blank space next to the definition.

Definitions:

Equity

Fair treatment and fairness in opportunity, distribution of resources, and recognition within an organization or society.

Social Responsibility

The obligation of individuals, groups, or organizations to act for the benefit of society at large, considering the impact of their activities.

High Status Persons

Individuals who hold a position of power, prestige, or high social standing within a group or society.

Communication

The process of exchanging information, ideas, thoughts, and feelings between people through speech, writing, visuals, or behavior.

Q2: The National Association of College and University

Q4: To provide a meaningful interpretation of a

Q6: During the years ended June 30,2017 and

Q8: "Financial statements are virtually useless in evaluating

Q30: The federal government is considering a national

Q31: The following are key terms in Chapter

Q38: General capital assets financed wholly or partially

Q40: Balsam City's library board is appointed by

Q42: The Town of Windsor issued the following

Q51: In which of the following funds is