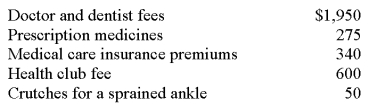

Maria is single and age 32.In 2014,she had AGI of $35,000.During the year,she incurred and paid the following medical costs:  What is Maria's medical expense deduction (after application of the adjusted gross income limitation) for her 2014 tax return?

What is Maria's medical expense deduction (after application of the adjusted gross income limitation) for her 2014 tax return?

Definitions:

Proximal Mothers

This term does not have a widely recognized definition in the context provided. NO.

Distal Mothers

Refers to mothers who provide care from a distance, often due to work or other obligations, impacting the mother-child attachment process.

Center-based Infant Care

Care provided to infants and toddlers in a dedicated facility staffed by professionals specializing in early childhood development.

Securely Attached

A secure emotional bond between individuals, characterized by trust and confidence in the relationship.

Q5: Jonathan is married,files a joint return,and has

Q13: Capital projects funds differ from the General

Q21: Revenues is an example of what the

Q29: The FASB standards require not-for-profit entities to

Q36: Which of the following will require a

Q41: A Subchapter S corporation must be a

Q45: When a corporation is formed,if the sole

Q61: Guaranteed payments are always determined with regard

Q62: Which of the deductions listed below is

Q62: If a taxpayer trades a personal-use asset