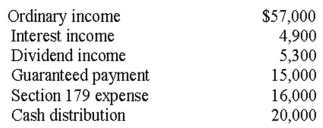

Partner Spence had the following items reported on a partnership Schedule K-1:  Spence had a basis in his partnership interest of $23,000 at the beginning of the year.What is Spence's basis in his partnership interest at the end of the year?

Spence had a basis in his partnership interest of $23,000 at the beginning of the year.What is Spence's basis in his partnership interest at the end of the year?

Definitions:

Percent of Assets

A measure or indicator expressed as a percentage of a company's total assets.

Interest Coverage Ratio

A financial metric used to determine how easily a company can pay interest on outstanding debt with its current earnings before interest and taxes.

Debt Ratio

A financial ratio that measures the proportion of a company's total debt to its total assets.

Operating Activities

Those activities directly related to the production, sale, and delivery of a company's products or services, as reflected in its income statement.

Q15: Sandy is a self-employed health information coder.She

Q17: Presley and Jake are married filing joint

Q18: Personal casualty losses resulting from termite damage

Q38: Miguel contributes land to a partnership with

Q56: Government-wide financial statements are prepared using the

Q61: Blue Company has taxable income of $90,000

Q68: The gross profit percentage is typically the

Q79: Kasey is 72 years old.She purchased a

Q92: Ramona is a 50% shareholder in a

Q103: How does the declaration of a federally