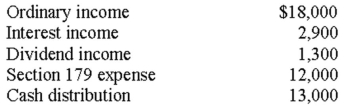

Partner Tami (a 20% partner) had the following items reported to her on a partnership Schedule K-1:  Tami had a basis in her partnership interest of $14,000 at the beginning of the year.Additionally,the partnership has recourse liabilities of $100,000 outstanding at the end of the year.What is Tami's basis in her partnership interest at the end of the year?

Tami had a basis in her partnership interest of $14,000 at the beginning of the year.Additionally,the partnership has recourse liabilities of $100,000 outstanding at the end of the year.What is Tami's basis in her partnership interest at the end of the year?

Definitions:

UCC

The Uniform Commercial Code, a comprehensive set of laws governing commercial transactions in the United States, intended to standardize and simplify the law across jurisdictions.

Renunciation

The formal rejection of a claim, right, or possession, usually involving a legal or official declaration.

Forbear

To refrain from enforcing a right or claim, or to abstain from doing something.

Unilateral Contract

A contract in which one party makes a promise in exchange for the other party's performance, rather than a promise in return.

Q1: The GASB concept statements indicate that in

Q7: After computing all tax preferences and AMT

Q19: The AMT tax rate for individuals is

Q32: Distributions from Health Savings Accounts (HSAs)are subject

Q33: Household workers are subject to FUTA tax

Q58: Capital assets used by an enterprise fund

Q66: Windy Company has taxable income before DRD

Q67: On December 28,2014,Misty sold 300 shares of

Q122: For all annuity contracts,to determine the expected

Q124: The more exemptions claimed,the more tax that