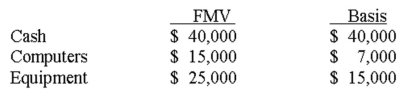

Callie contributes the following assets to a partnership in exchange for a 30% partnership interest:  What is Callie's beginning basis in her partnership interest?

What is Callie's beginning basis in her partnership interest?

Definitions:

Fundamental Analysis

An approach in finance that assesses securities by attempting to measure their intrinsic value through examining related economic, financial, and other qualitative and quantitative factors.

Mutual Funds

Investment funds that pool money from many investors to purchase a diversified portfolio of stocks, bonds, or other securities.

Annual Reports

Annual reports are comprehensive documents produced by companies at the end of an accounting year, detailing their operational and financial performance, intended for shareholders and potential investors.

Insurance Company

A financial institution that provides a range of insurance policies to protect individuals and businesses against various risks.

Q37: In order for a personal property tax

Q39: The general rule concerning passive losses is

Q50: When dealing with the liquidation of a

Q54: To qualify for a medical expense deduction

Q55: Jena is a self-employed fitness trainer who

Q55: All taxpayers must file Form 1116 to

Q58: Which of the following is a refundable

Q99: Theft losses are deducted in the tax

Q110: The threshold amount for the deductibility of

Q113: If the modified AGI of a married