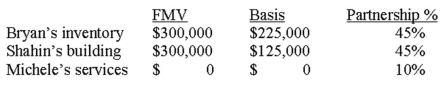

Bryan,Shahin,and Michele form a partnership.Bryan and Shahin contribute inventory and a building,respectively.Michele agrees to perform all of the accounting and office work in exchange for a 10% interest.  a.Do any of the partners recognize any gain? If so,how much and why?

a.Do any of the partners recognize any gain? If so,how much and why?

b.What is each partner's basis in his or her partnership interest?

c.What is the basis to the partnership of each asset?

Definitions:

Alternative Hypothesis

The hypothesis that proposes a difference or effect, in contrast to the null hypothesis, which assumes no effect or difference.

Significance Level

The probability of rejecting the null hypothesis in a statistical test when it is actually true, often denoted by alpha (α).

Alternative Hypothesis

A hypothesis that contradicts the null hypothesis, indicating that there is a significant difference between specified populations.

Significance Level

Another term for level of significance, denoting the cutoff probability for determining when the p-value indicates a statistically significant result.

Q5: Jonathan is married,files a joint return,and has

Q21: Which of the following types of taxes

Q22: The following are fund balance classifications described

Q22: Which of the following statements is incorrect?<br>A)

Q24: Melissa earned net investment income of $11,000

Q36: In order to qualify for a Health

Q52: If Casey's partnership basis is only $100,000

Q76: Itemized deductions are first reported on:<br>A)Form 1040.<br>B)Schedule

Q96: Which of the following items is subtracted

Q118: Corporate distributions to shareholders from earnings and