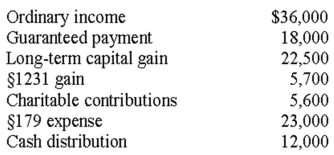

Rita has a beginning basis in a partnership of $43,000.Rita's share of income and expense from the partnership consists of the following amounts:  a.What items are separately stated?

a.What items are separately stated?

b.What is Rita's self-employment income?

c.Calculate Rita's partnership basis at the end of the year.

Definitions:

Percentage

A portion of a whole expressed as a fraction of 100, used in quantifying proportions and ratios.

Descriptive Statistics

Statistical methods that summarize and organize data collected from a sample or population, including measures such as mean, median, and standard deviation.

Numerical Indexes

Measures or indicators that are expressed as numbers, often used to compare and analyze data.

Mean

The arithmetic average of a set of values, calculated by summing the values and then dividing by the number of values.

Q12: Most real estate debt meets the requirements

Q19: Julia exchanges a machine used in her

Q52: Which of the following organizations issue standards

Q57: Sabrina has a $12,000 basis in her

Q71: In order to obtain and retain qualified

Q73: What are four major categories of deductible

Q87: Qualified education expenses for the purpose of

Q88: All C corporations file their tax returns

Q106: Purple Company makes and sells computer printers.It

Q115: Schedule M-1 reconciles from net income per