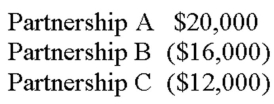

Spencer has an ownership interest in three passive activities.In the current tax year,the activities had the following income and losses:  How much in passive losses can Spencer deduct?

How much in passive losses can Spencer deduct?

Definitions:

Free-association Technique

A therapeutic method used in psychoanalysis where patients are encouraged to verbalize thoughts as freely as they occur.

Benzodiazepines

A class of psychoactive drugs used primarily for treating anxiety, insomnia, and other disorders by enhancing the effect of the neurotransmitter GABA.

Monoamine Oxidase

An enzyme that plays a role in breaking down neurotransmitters such as serotonin and dopamine, influencing mood and emotional states.

Selective Serotonin Reuptake Inhibitors

A class of drugs typically used as antidepressants in the treatment of major depressive disorder, anxiety disorders, and some personality disorders by increasing serotonin levels in the brain.

Q25: Barbara and Michael (wife and husband)are itemizing

Q46: If Janelle's partnership basis was $5,000 and

Q66: Which of the following statements is incorrect?<br>A)

Q70: Copy A of the Form W-2 is

Q81: A qualifying individual for the purposes of

Q95: The withholding tables are structured so that

Q97: Kathy received a commission of $12,000 from

Q106: The maximum amount per year of dependent

Q115: On January 3,2014,Norman employed a part-time household

Q124: If a taxpayer pays for an annuity