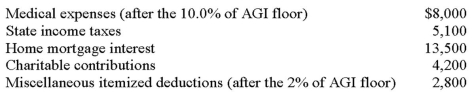

Cal reported the following itemized deductions on his 2014 tax return.His AGI for 2014 was $85,000.The mortgage interest is all qualified mortgage interest to purchase his personal residence.For AMT,compute his total itemized deductions.

Definitions:

Nervous System

The network of nerve cells and fibers that transmit signals between different parts of the body, coordinating actions and sensory information.

Musculoskeletal System

The system in the human body that includes bones, muscles, cartilage, tendons, ligaments, joints, and other connective tissue, supporting body movement and providing form, support, stability, and protection to vital organs.

Circulatory System

The body's system responsible for transporting blood, nutrients, oxygen, carbon dioxide, and hormones throughout the body.

Neurotransmitter Systems

Networks within the brain that use specific neurotransmitters to communicate and regulate various physiological processes and behaviors.

Q5: Flow-through entities file "informational returns."

Q40: Which of the following statements is incorrect?<br>A)

Q45: The self-employed health insurance deduction is also

Q47: A corporation has a fiscal-year end of

Q48: The receipt of boot in a like-kind

Q72: Residential rental properties are depreciated using the

Q76: Joe is paid $975 per week.Using the

Q94: Employees age 50 or over can contribute

Q106: Retirement plans can be categorized into employer-sponsored

Q125: Form 4070 is used by employers to