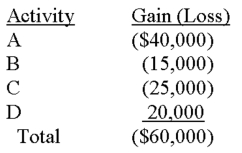

Baird has four passive activities.The following income and losses are generated in the current year.  How much of the $60,000 net passive loss can Baird deduct this year? Calculate the suspended losses (by activity).

How much of the $60,000 net passive loss can Baird deduct this year? Calculate the suspended losses (by activity).

Definitions:

Existing Customers

Individuals or entities that have previously purchased or are currently using a company's products or services.

Marketing Strategy

A comprehensive plan formulated by an organization to achieve its marketing objectives and satisfy target market needs.

Product Development

The creation of new products or improvements to existing products, including design, manufacturing, and marketing considerations.

Marketing Mix

A set of actions, or tactics, that a company uses to promote its brand or product in the market, commonly identified as product, price, place, and promotion.

Q13: Louis,who is single,sold his house in St.Louis

Q26: In a large food or beverage establishment,on

Q58: Sabrina has a $12,000 basis in her

Q59: Credit for child and dependent care expenses

Q71: The Tara Partnership (not involved in real

Q91: Schedule H is completed by the household

Q98: Edward and Ethel are ages 71 and

Q120: Kim paid the following expenses during November

Q122: Which of the following statements is not

Q124: Valarie owns 100% of Green Company.Green has