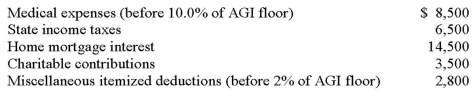

Antonio reported the following itemized deductions on his 2014 tax return.His AGI for 2014 was $95,000.The mortgage interest is all qualified mortgage interest to purchase his personal residence.For AMT,compute his total adjustment for itemized deductions.

Definitions:

Insomnia

A sleep disorder where individuals have difficulty falling asleep, staying asleep, or experience non-restorative sleep, leading to distress or impairment in daily functioning.

Mental Flexibility

The ability to adapt one's thinking and behavior in response to changing circumstances or new information.

Creativity

The ability to produce original and valuable ideas or solutions by thinking outside the conventional boundaries.

Sigmund Freud

An Austrian neurologist and the founder of psychoanalysis, a clinical method for treating psychopathology through dialogue between a patient and a psychoanalyst.

Q4: Richard's business is condemned by the state

Q29: Discuss the limitations of the lifetime learning

Q46: What is the AMT exemption amount for

Q52: Debbie files as head of household and

Q53: An equipment leasing activity is not subject

Q61: Tax-deferred plans are only available for purposes

Q63: Rick and Claudia live in an apartment

Q83: Once a corporation properly elects to be

Q83: What is the maximum amount of personal

Q87: Qualified education expenses for the purpose of