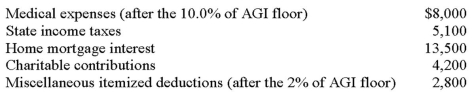

Cal reported the following itemized deductions on his 2014 tax return.His AGI for 2014 was $85,000.The mortgage interest is all qualified mortgage interest to purchase his personal residence.For AMT,compute his total itemized deductions.

Definitions:

Tab Order

Refers to the sequence in which the focus moves from one field or control to another when the user presses the Tab key.

Form Layout

The arrangement of visual elements in a form, determining how fields, labels, and other components are displayed.

Tabbed Pages

A user interface design that organizes content into separate views accessed by tabs.

Tab Control

A graphical control element that allows multiple documents or panels to be contained within a single window, accessed by tabs.

Q6: What is the maximum deductible contribution that

Q13: For 2014,taxpayers are eligible to take a

Q24: Which of the following expenses does not

Q34: A partner's share of recourse liabilities increases

Q53: An equipment leasing activity is not subject

Q66: Claudia invested $50,000 cash in the C&S

Q70: Taxpayers are required to use the installment

Q90: Escobar and Rose are both age 36

Q92: Juan is married,is paid 2,000 per week,and

Q104: Under a divorce agreement executed in 2014,periodic