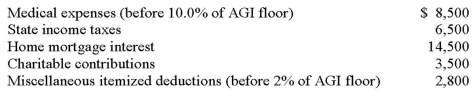

Antonio reported the following itemized deductions on his 2014 tax return.His AGI for 2014 was $95,000.The mortgage interest is all qualified mortgage interest to purchase his personal residence.For AMT,compute his total adjustment for itemized deductions.

Definitions:

Aneurysm

Dilated portion of an artery.

Artery Wall

The multi-layered structure of arteries consisting of the tunica intima, tunica media, and tunica externa, crucial for maintaining blood pressure and flow.

Veins Overstretching

A condition where veins are stretched beyond their normal capacity, often leading to varicose veins.

Posterior Cerebral

Pertaining to the back part of the cerebral cortex, which is involved in processing visual information.

Q7: Angie earned $120,000 during 2014.She is single,claims

Q20: The federal income and social security taxes

Q23: The term "step-into-the-shoes" means that the partnership

Q33: Household workers are subject to FUTA tax

Q36: Paul invests $10,000 cash in an equipment

Q49: Basira transfers land with a FMV of

Q73: On an involuntary conversion in which the

Q97: Rick and Lenora were granted a divorce

Q106: The maximum amount per year of dependent

Q116: Which of the following statements is incorrect?<br>A)