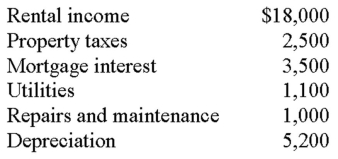

In the current year,Marnie rented her vacation home for 75 days,used it for personal reasons for 22 days,and left it vacant for the remainder of the year.Her income and expenses are as follows:  What is Marnie's net income or loss from the activity? Use the Tax Court method. (Round your answer to the nearest whole dollar)

What is Marnie's net income or loss from the activity? Use the Tax Court method. (Round your answer to the nearest whole dollar)

Definitions:

Conspicuous Consumption

The ostentatious display of goods to mark one’s social status.

Ethnocentrism

The belief in the inherent superiority of one's own ethnic group or culture, often accompanied by feelings of prejudice towards other groups.

Cultural Relativism

The principle of understanding and judging a culture by its own values and standards rather than applying the standards of another culture.

Ethnocentrism

Ethnocentrism is the belief in the inherent superiority of one's own ethnic group or culture, often accompanied by prejudice or discrimination against other groups.

Q3: Yolanda,a single taxpayer,has W-2 income of $87,500.She

Q12: Receipt of property or services will trigger

Q13: Dan sold 135 shares (assume 100 are

Q14: Why is the concept of "Adjusted Gross

Q20: The federal income and social security taxes

Q34: Entities such as partnerships,LLC's,and S Corporations are

Q35: The tax code defines adjusted gross income

Q99: What is the definition of qualifying child

Q108: Jury duty pay is taxable income but

Q114: The basic standard deduction in 2014 for