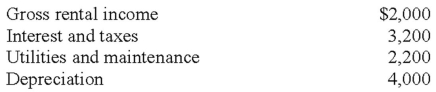

Lori and Donald own a condominium in Colorado Springs,Colorado,that they rent out part of the time and use during the summer.The rental property is classified as personal/rental property and their personal use is determined to be 75% (based on the IRS method) .They had the following income and expenses for the year (before any allocation) :  How much net loss should Lori and Donald report for their condominium on their tax return this year?

How much net loss should Lori and Donald report for their condominium on their tax return this year?

Definitions:

Batterers

Individuals who engage in physical, emotional, or sexual abuse against their partners.

Helplessness

A state of being unable to prevent or avoid negative outcomes, often leading to a lack of effort or motivation.

Post-Traumatic Stress Disorder

A psychiatric disorder that can occur in people who have experienced or witnessed a traumatic event, such as a natural disaster, a serious accident, a terrorist act, war/combat, or rape or who have been threatened with death, sexual violence, or serious injury.

Intimate Partner Violence

Aggression toward those who are in close relationships to the aggressor.

Q3: Della purchased a warehouse on February 25,2014,for

Q26: If the taxpayer still owes tax after

Q33: Rose,who files as head of household,reported itemized

Q72: Jack is married,is paid $5,000 biweekly,and claims

Q87: Discounts provided to employees for food by

Q107: Supplemental wages are subject to the following

Q108: Personal exemptions are for the taxpayer and

Q113: Constructive receipt means the income is available

Q117: Clarisse's filing status is head of household.She

Q131: Brian and Clara paid $4,350 in foreign