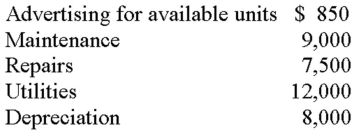

Reggie and Bebe own an apartment building in Portland,Oregon,with 8 identical units.They live in one and rent the remaining units.Their rental income for the year was $45,000.They incurred the following expenses for the entire building:  What amount of net income should Reggie and Bebe report for the current year for this rental? (Round your answer to the nearest whole dollar)

What amount of net income should Reggie and Bebe report for the current year for this rental? (Round your answer to the nearest whole dollar)

Definitions:

Mistrial

A trial rendered invalid through an error, mishap, or juror misconduct, necessitating a retrial.

Secondary Territory

Area, such as the desk you usually sit at, that you don’t really own but nonetheless consider to be “yours.”

English Class

An English class is an academic course focused on the study and application of the English language, including grammar, literature, writing, and reading comprehension.

Public Library

A community institution that provides access to a wide range of information resources, including books, digital media, and educational programs, free of charge.

Q12: What is a good rule of thumb

Q31: Cooper is a single dad with 1

Q41: The child tax credit of $1,000 per

Q62: Anike received property as part of an

Q63: Brad and Kate received $9,500 for rent

Q86: In the case of personal/rental property,a taxpayer

Q87: All rental properties are depreciated using the

Q99: Eddie and Camilla received $11,600 for the

Q109: The tax liability for a married couple

Q110: Daniel is a computer technical support representative